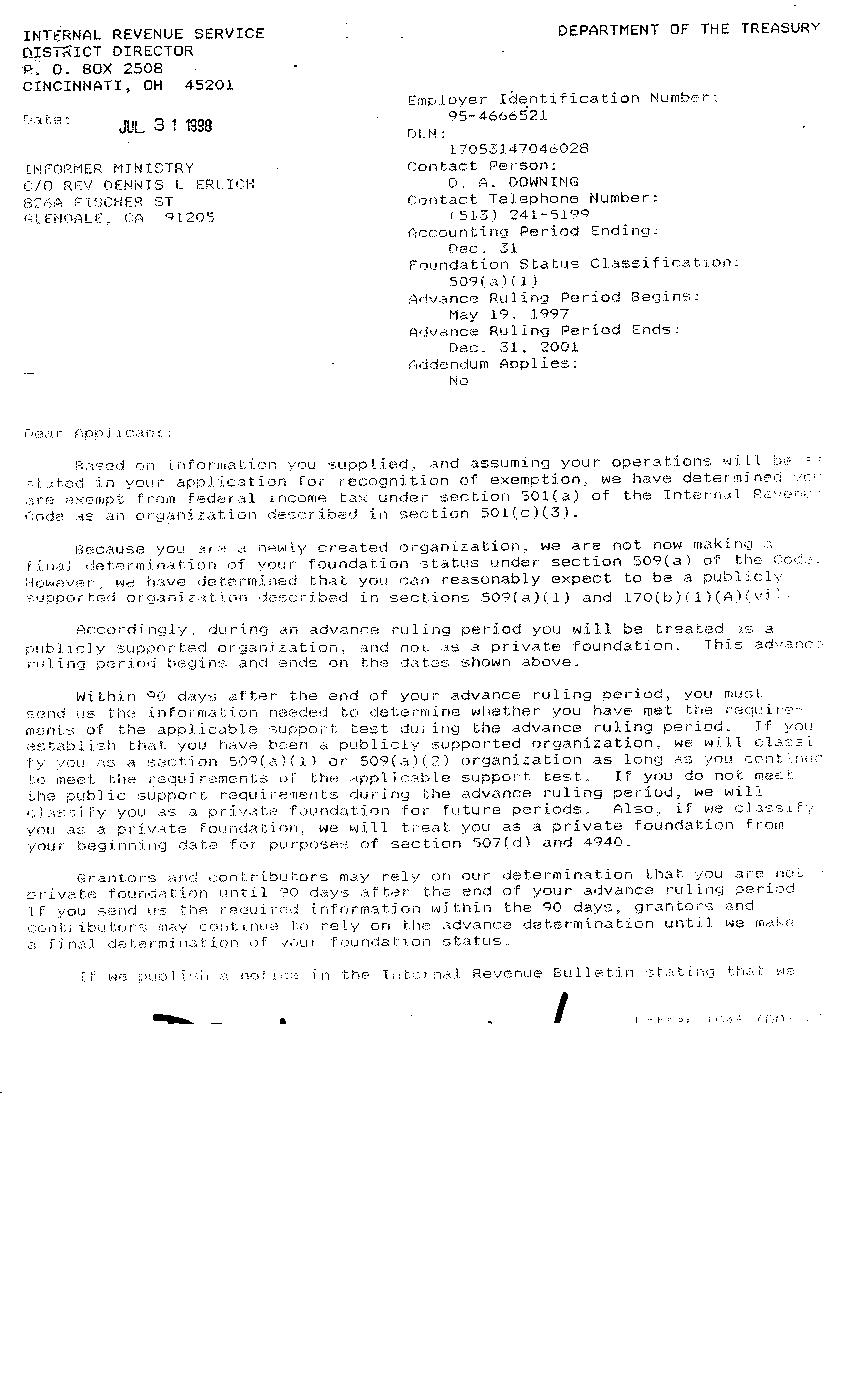

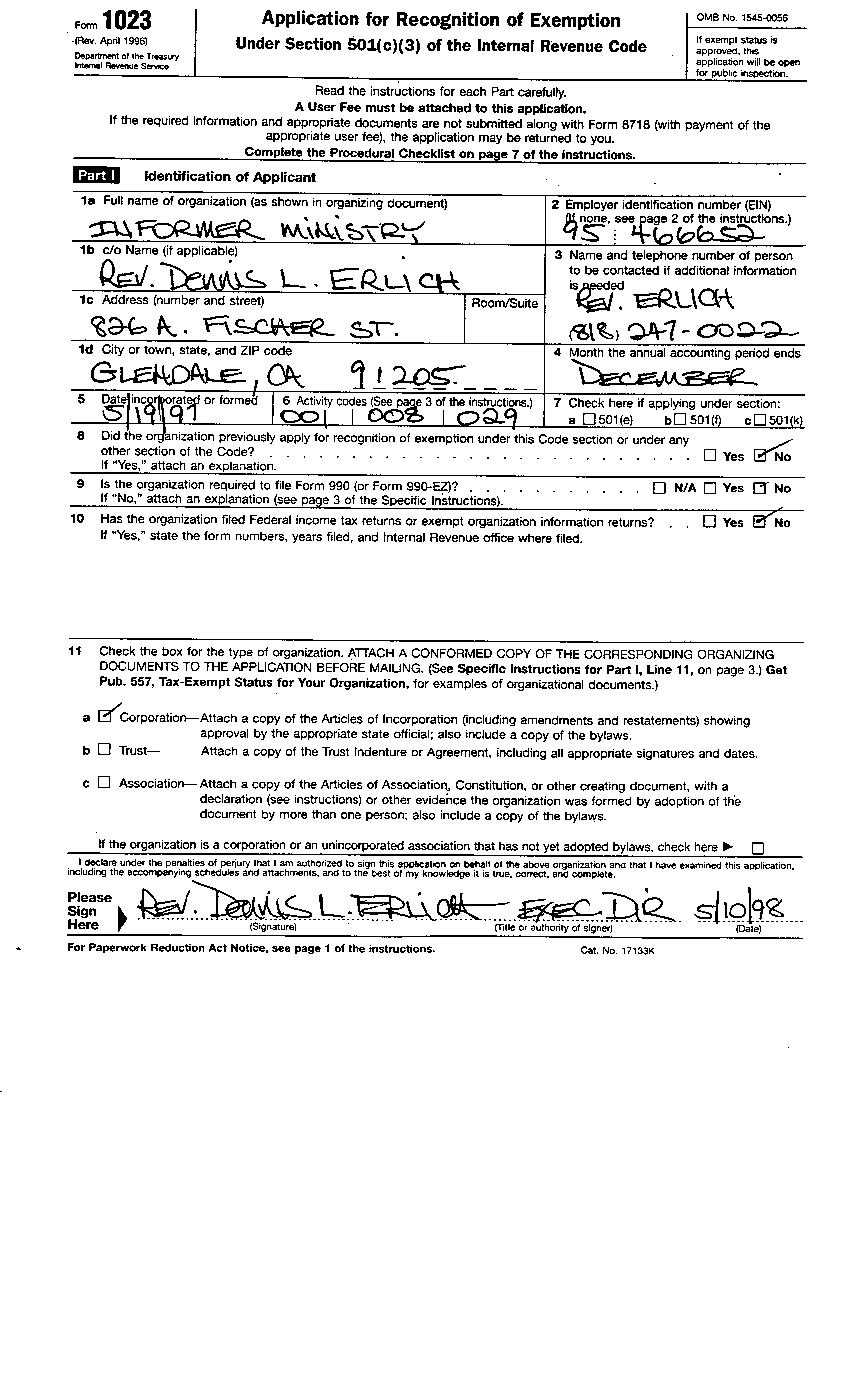

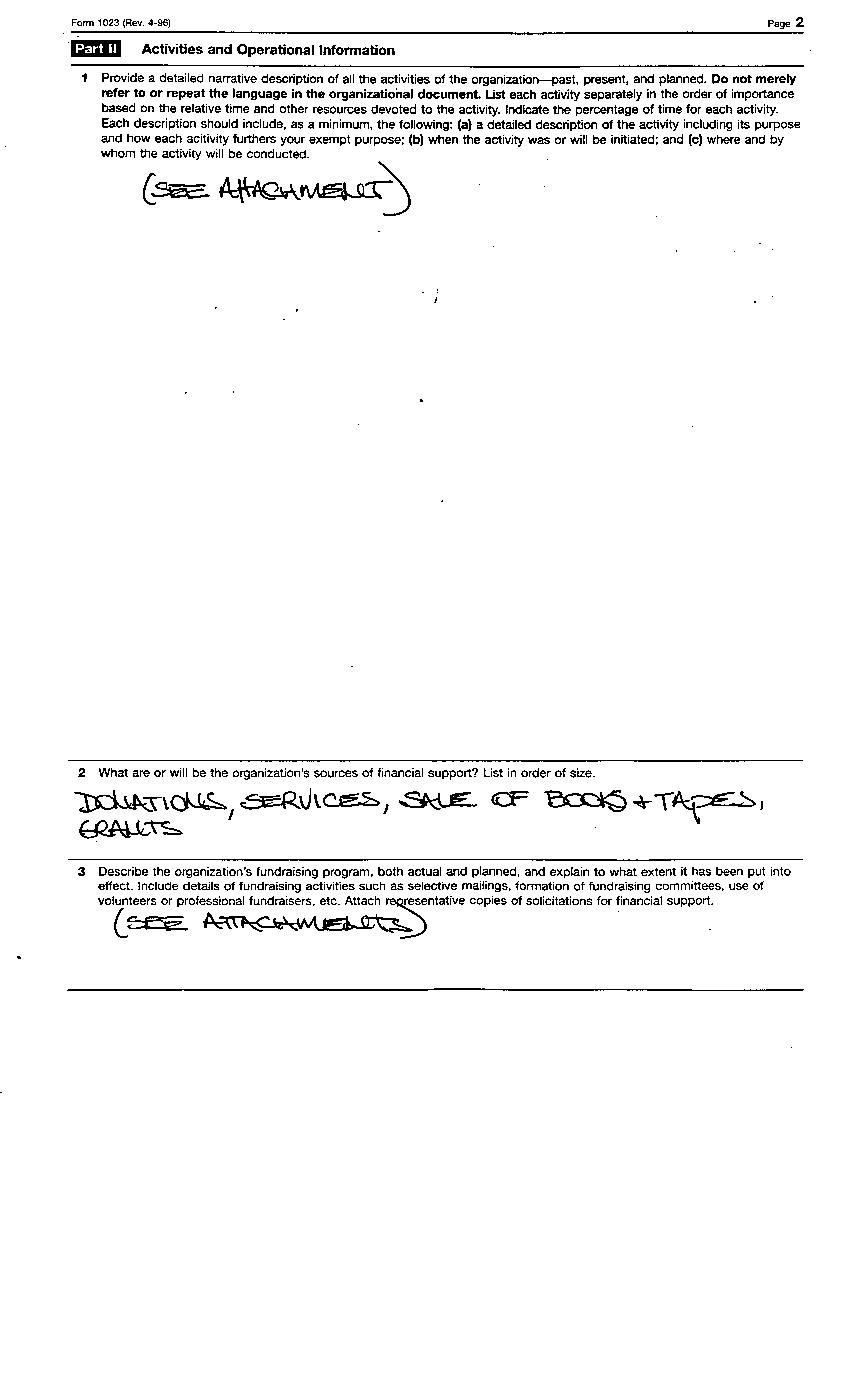

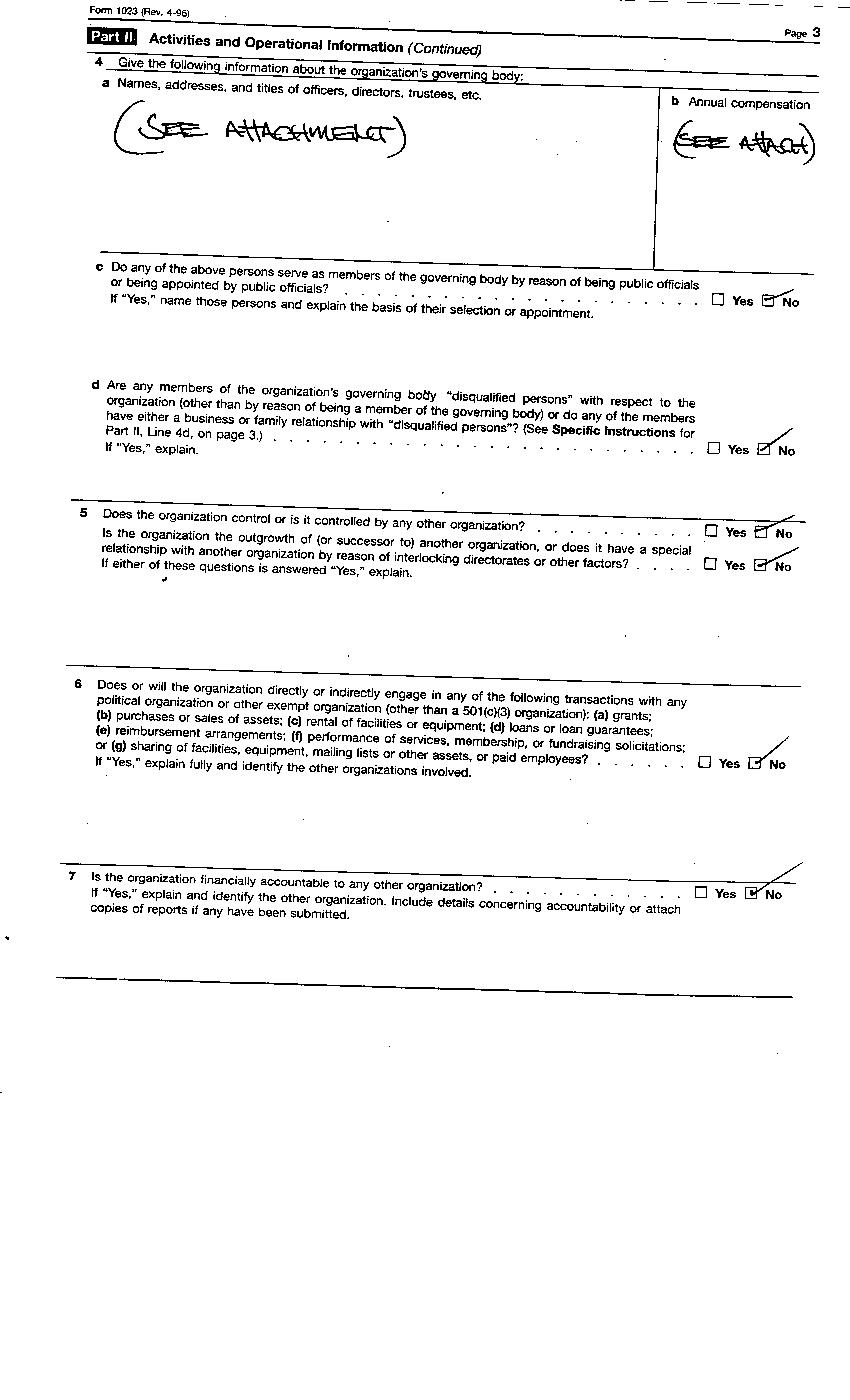

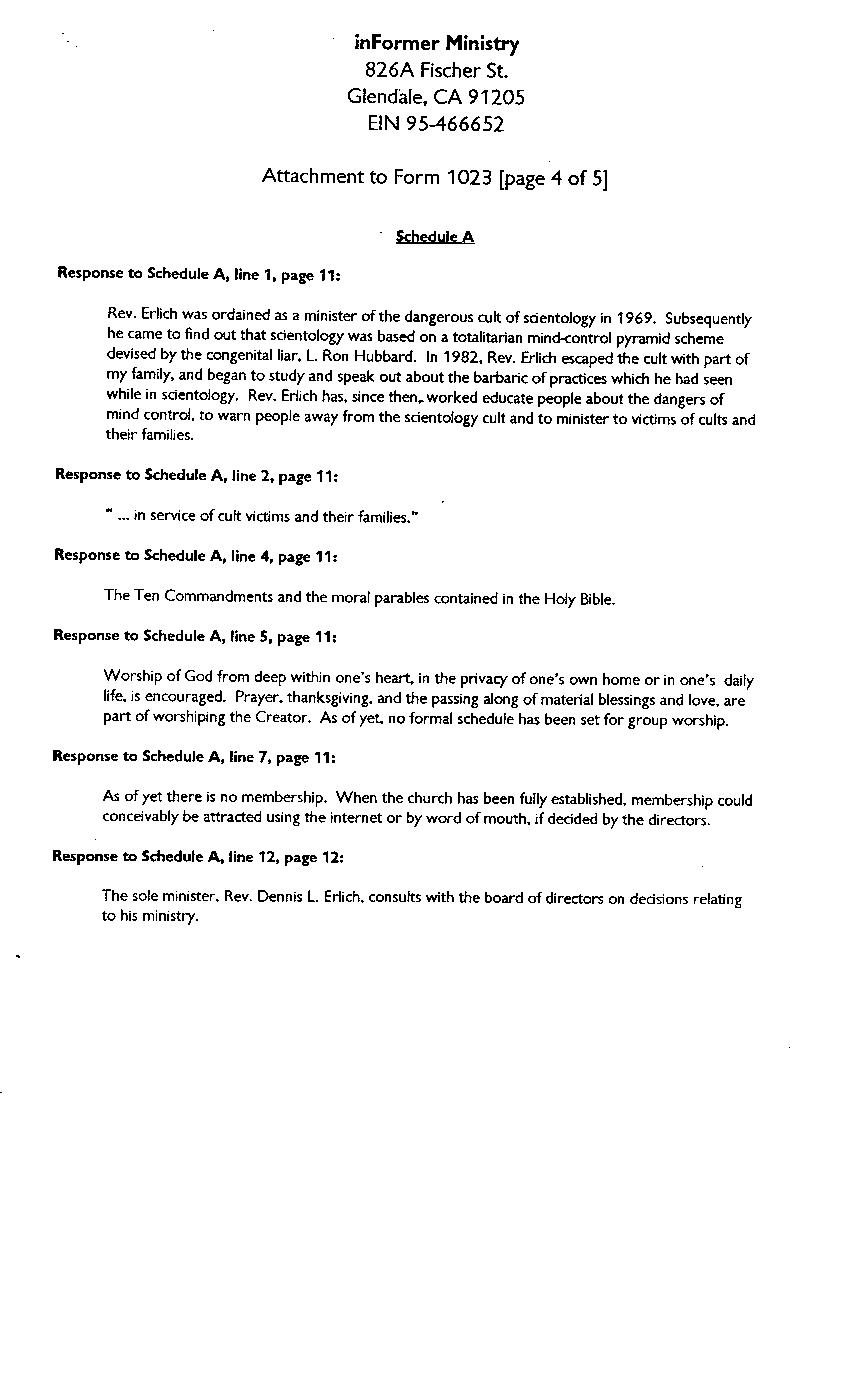

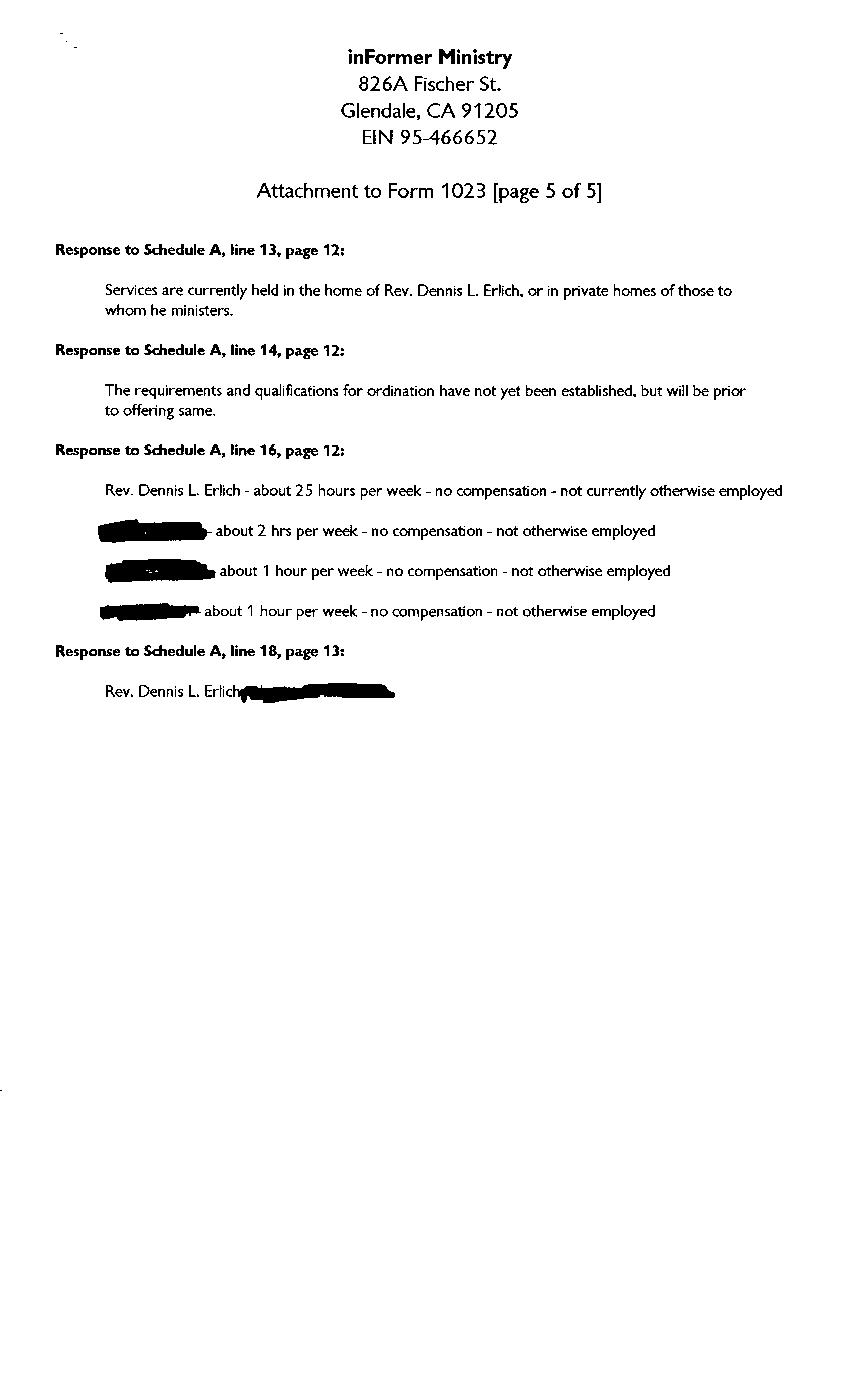

inFormer Ministry

Public Disclosure Docs

-------------------------------------------------------

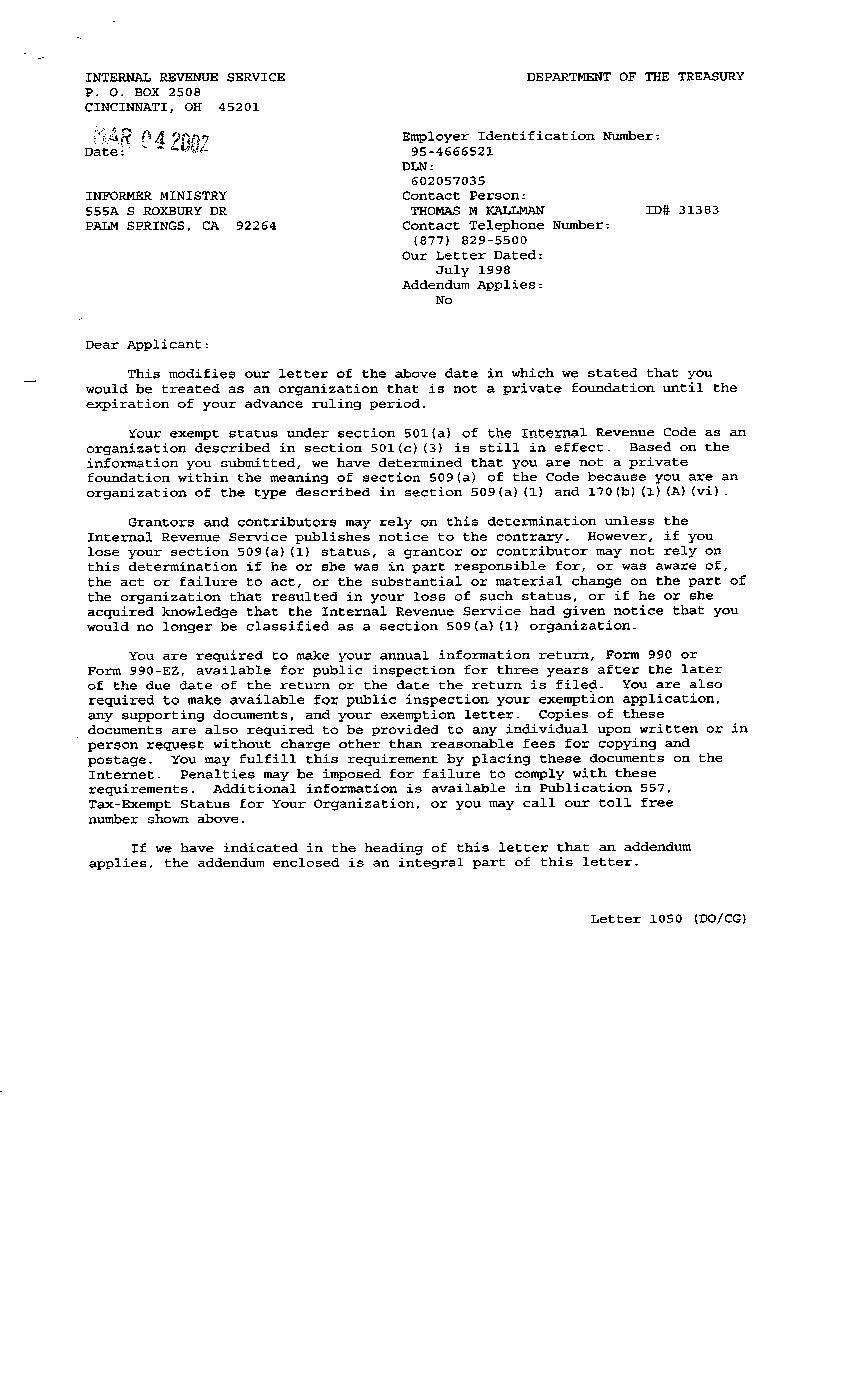

The ministry has had two requests to view public scrutiny documents in the

11 years of its existence.

One was from a cult. They sent a private investigator in 1998 to examine the

documents during a federal case they had filed against me.

And the other was from Tom Klemesrud who has made threats against the ministry.

Rather than respond to individual requests,

(and especially requests such as the above from those who have engaged or

continue to engage in harassment campaigns against me or my ministry)

we have placed online copies of documents requiring public disclosure.

You will find them here below.

You can also request them from the IRS by filling out:

http://www.irs.gov/pub/irs-pdf/f4506a.pdf

instructions here:

http://www.irs.gov/pub/irs-pdf/i4506a.pdf

You may contact us with comments about the ministry:

http://www.informer.org/contact.html

Rev. Dennis L Erlich

____________________________________________________________________________

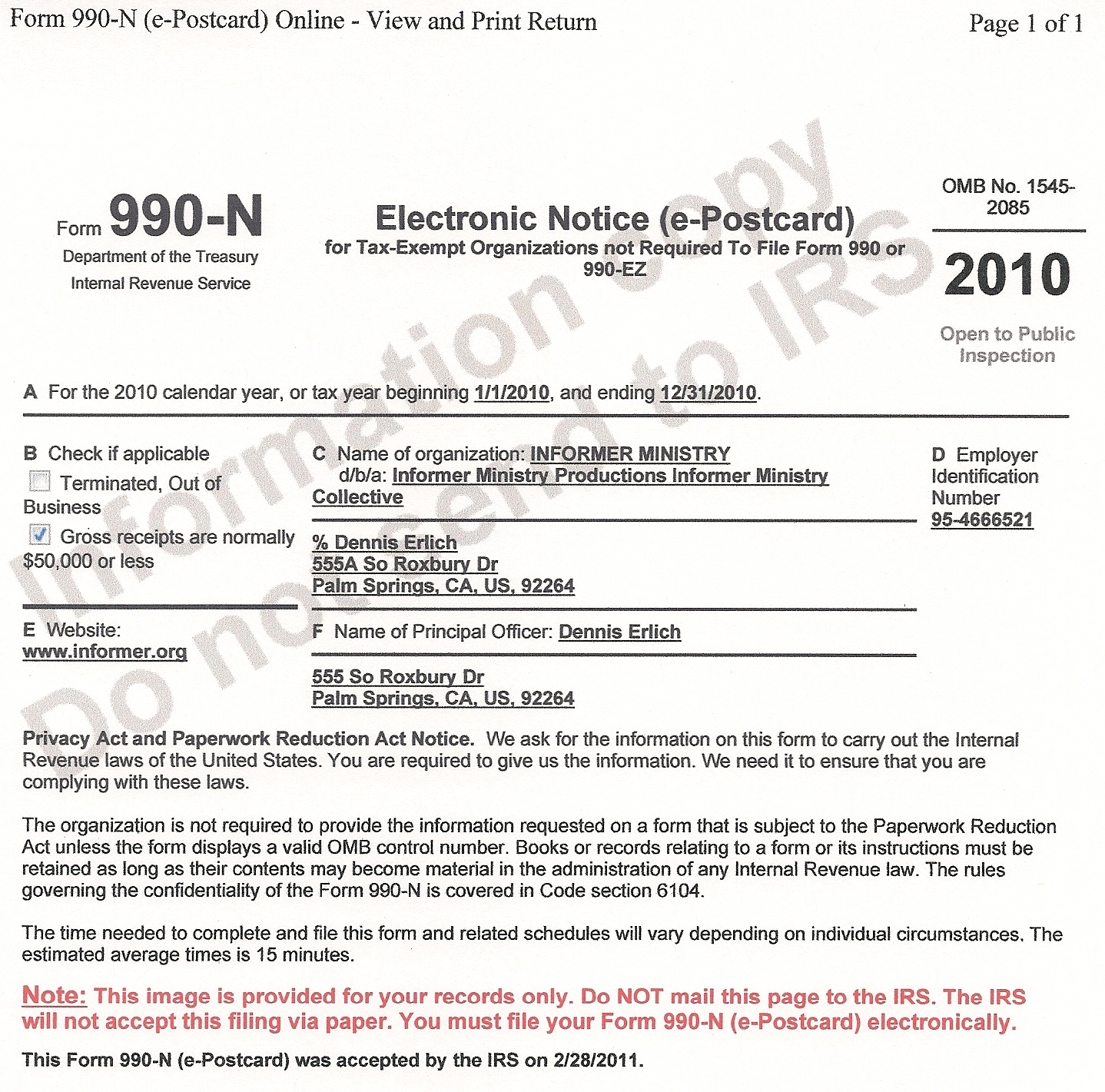

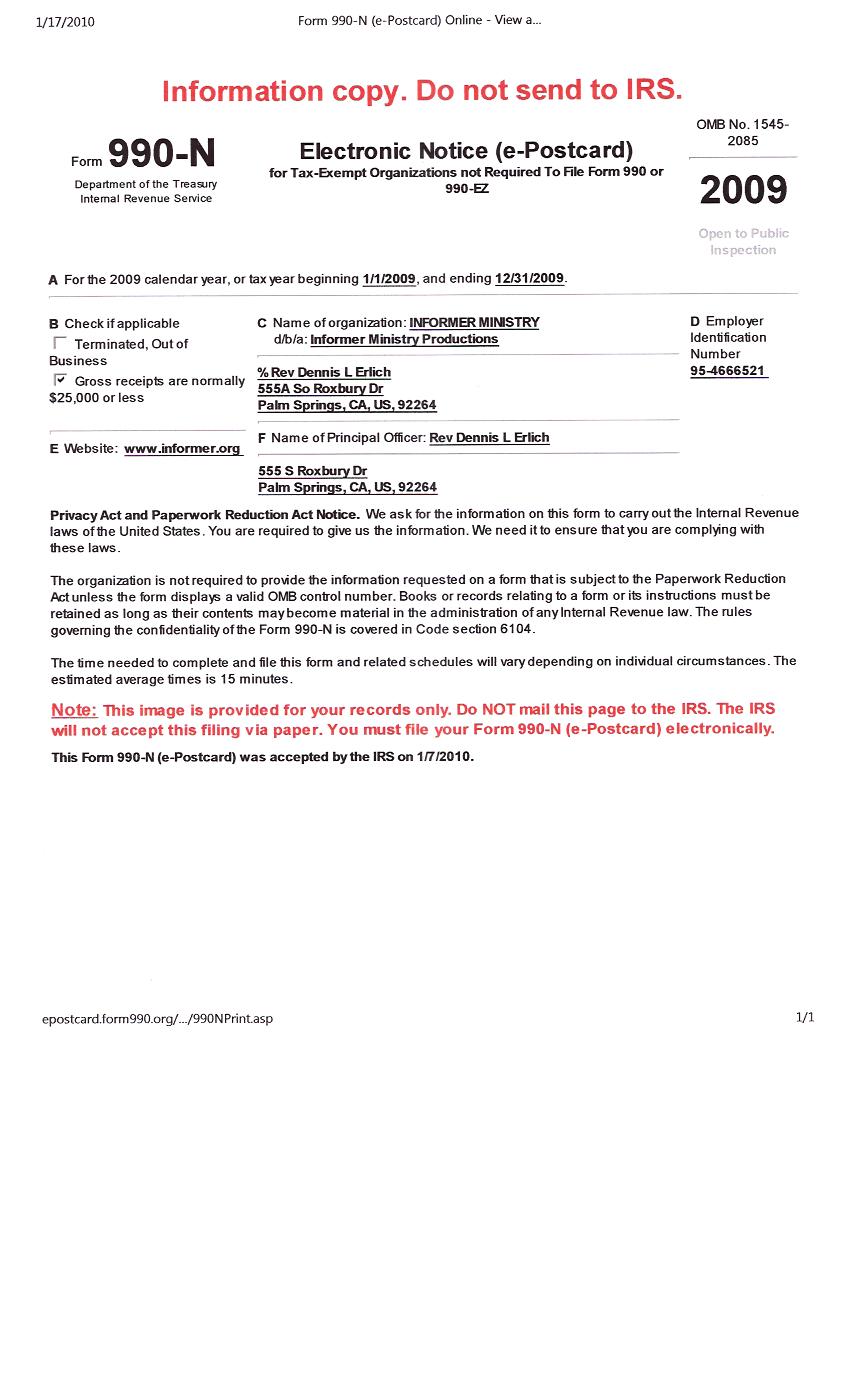

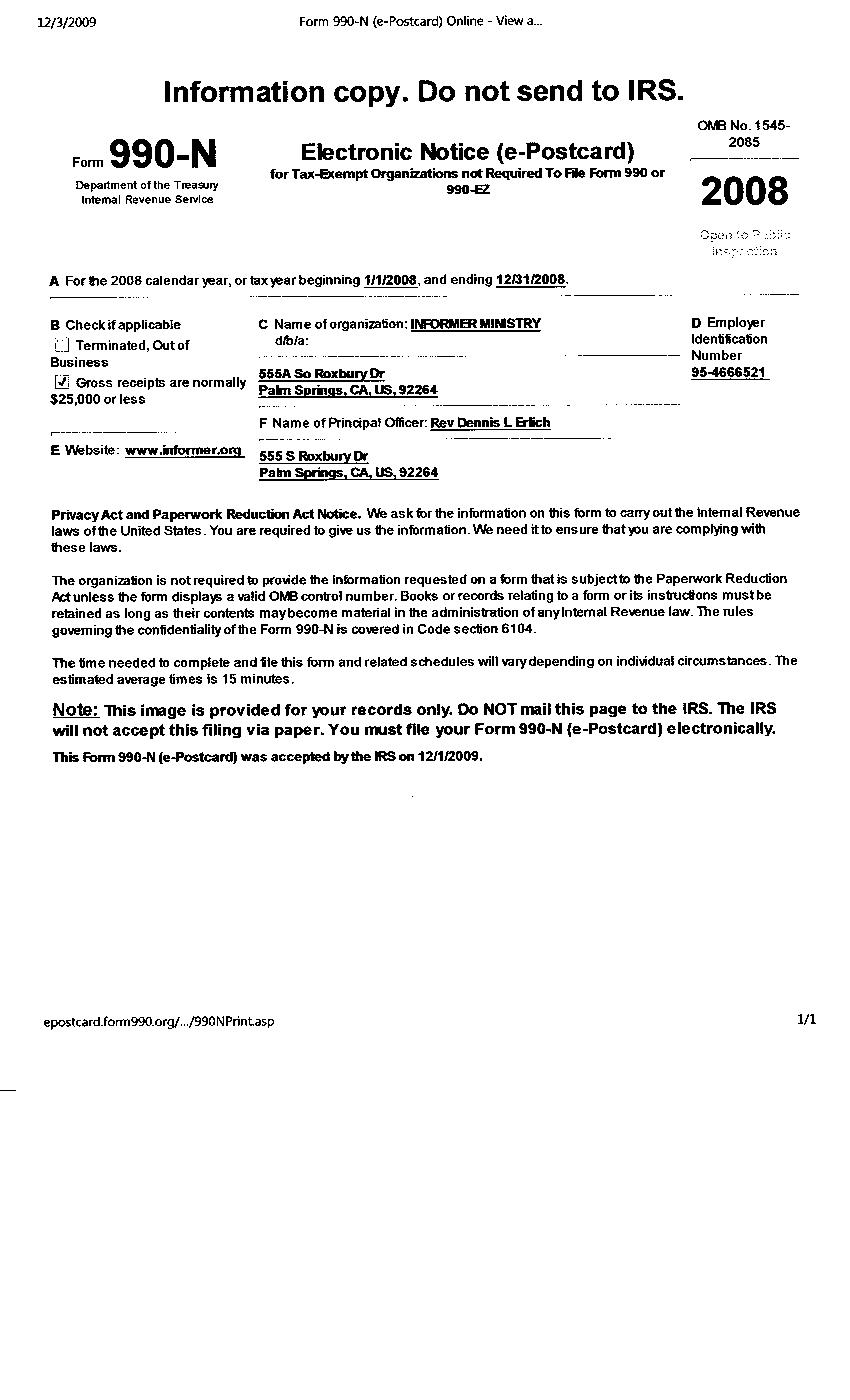

6/12/12 Form 990-N (e-Postcard) Online - View and Print Return

file:///C:/documents/legal/Form 990-N (e-Postcard) 2011.htm 1/1

Information copy. Do not send to IRS.

Form 990-N

Department of the Treasury

Internal Revenue Service

Electronic Notice (e-Postcard)

for Tax-Exempt Organizations not Required To File Form 990 or

990-EZ

OMB No. 1545-

2085

2011

Open to Public

Inspection

A For the 2011 calendar year, or tax year beginning 1/1/2011, and ending 12/31/2011.

B Check if applicable

Terminated, Out of

Business

Gross receipts are normally

$50,000 or less

E Website: www.informer.org

C Name of organization: INFORMER MINISTRY

d/b/a: Informer Ministry Productions Informer Ministry Collective

% Rev Dennis L Erlich

555A So Roxbury Dr

Palm Springs, CA, US, 92264

F Name of Principal Officer: Rev Dennis L Erlich

555 So Roxbury Dr

Palm Springs, CA, US, 92264

D Employer

Identification

Number

95-4666521

Privacy Act and Paperwork Reduction Act Notice. We ask for the information

on this form to carry out the Internal Revenue

laws of the United States. You are required to give us the information. We

need it to ensure that you are complying with

these laws.

The organization is not required to provide the information requested on a

form that is subject to the Paperwork Reduction

Act unless the form displays a valid OMB control number. Books or records

relating to a form or its instructions must be

retained as long as their contents may become material in the administration

of any Internal Revenue law. The rules

governing the confidentiality of the Form 990-N is covered in Code section

6104.

The time needed to complete and file this form and related schedules will

vary depending on individual circumstances. The

estimated average times is 15 minutes.

Note: This image is provided for your records only. Do NOT mail this page

to the IRS. The IRS

will not accept this filing via paper. You must file your Form 990-N (e-Postcard)

electronically.

This Form 990-N (e-Postcard) was accepted by the IRS on 6/11/2012.

-------------------------------------------------------------